Getting The Personal Loans Canada To Work

Individual finances included a taken care of principal and rate of interest monthly payment for the life of the loan, computed by building up the principal and the interest. A set price gives you the security of a foreseeable regular monthly settlement, making it a preferred option for consolidating variable price charge card. Payment timelines vary for individual fundings, but customers are commonly able to choose settlement terms between one and 7 years.

A Biased View of Personal Loans Canada

The charge is normally deducted from your funds when you complete your application, lowering the quantity of cash money you pocket. Individual loans rates are much more directly tied to short term rates like the prime rate.

You may be offered a reduced APR for a much shorter term, due to the fact that lending institutions know your equilibrium will certainly be repaid much faster. They might bill a higher rate for longer terms knowing the longer you have a car loan, the most likely something could change in your funds that can make the repayment unaffordable.

An individual loan is additionally an excellent choice to utilizing debt cards, given that you obtain money at a fixed price with a precise benefit date based on the term you pick. Maintain in mind: When the honeymoon is over, the monthly payments will certainly be a tip of the money you invested.

Personal Loans Canada - Questions

Prior to handling financial debt, use an individual car loan settlement calculator to help spending plan. Gathering quotes from several lenders can assist you detect the very best bargain and potentially save you passion. Compare rate of interest prices, fees and loan provider reputation before getting the loan. Your credit rating is a huge consider determining your eligibility for the lending as well as the passion price.

Before applying, know what your score is so that you understand what to expect in regards to expenses. Watch for surprise costs and penalties by reading the lender's terms and conditions page so you don't end up with less cash money than you require for your economic objectives.

Individual financings call for evidence you have the credit report profile and income to repay them. They're simpler to qualify for than home equity finances or other secured loans, you still require to show the lender you have the visit this website ways to pay the loan back. Personal loans are far better than bank card if you desire a set month-to-month payment and require all of your funds at the same time.

4 Simple Techniques For Personal Loans Canada

Credit report cards may likewise provide rewards or cash-back options that individual loans do not.

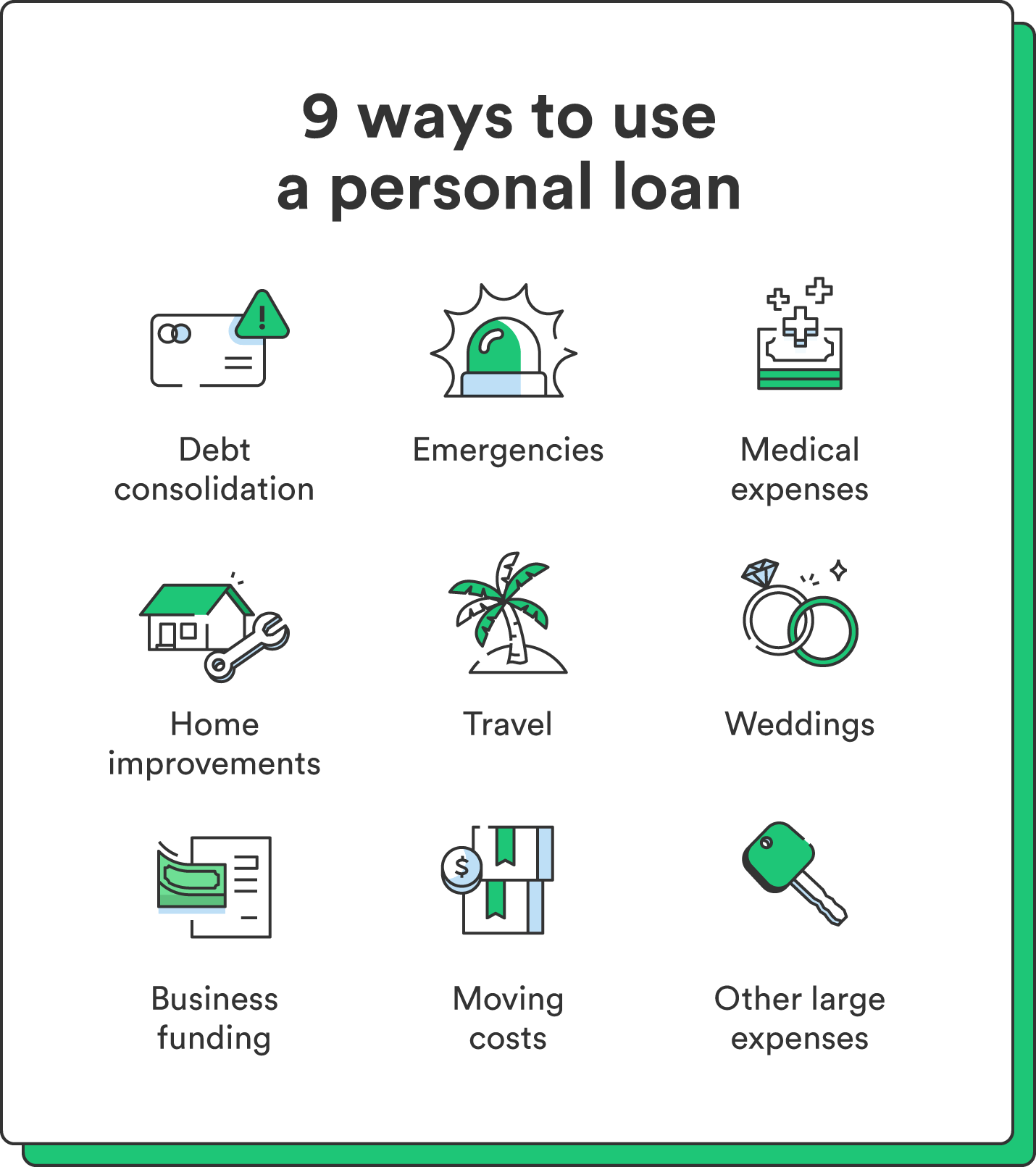

Some lending institutions might also bill fees for individual finances. Personal loans are financings that can cover a number of personal expenditures.

, there's typically a fixed end day by which i loved this the loan will be paid off. An individual line of credit rating, on the other hand, might continue to be open and available to you indefinitely as long as your account stays in excellent standing with your lender.

The money obtained on the finance is not tired. If the lender forgives the financing, it is taken into consideration a canceled debt, and that quantity can be exhausted. A secured personal lending calls for some kind of collateral as a condition of borrowing.

Some Known Details About Personal Loans Canada

An unsafe personal funding calls for go no security to obtain cash. Financial institutions, credit report unions, and online lending institutions can supply both secured and unsecured personal car loans to qualified debtors.

Once again, this can be a financial institution, lending institution, or online personal lending lender. Typically, you would first finish an application. The lending institution reviews it and decides whether to approve or refute it. If accepted, you'll be offered the finance terms, which you can approve or turn down. If you agree to them, the next action is settling your finance documents.